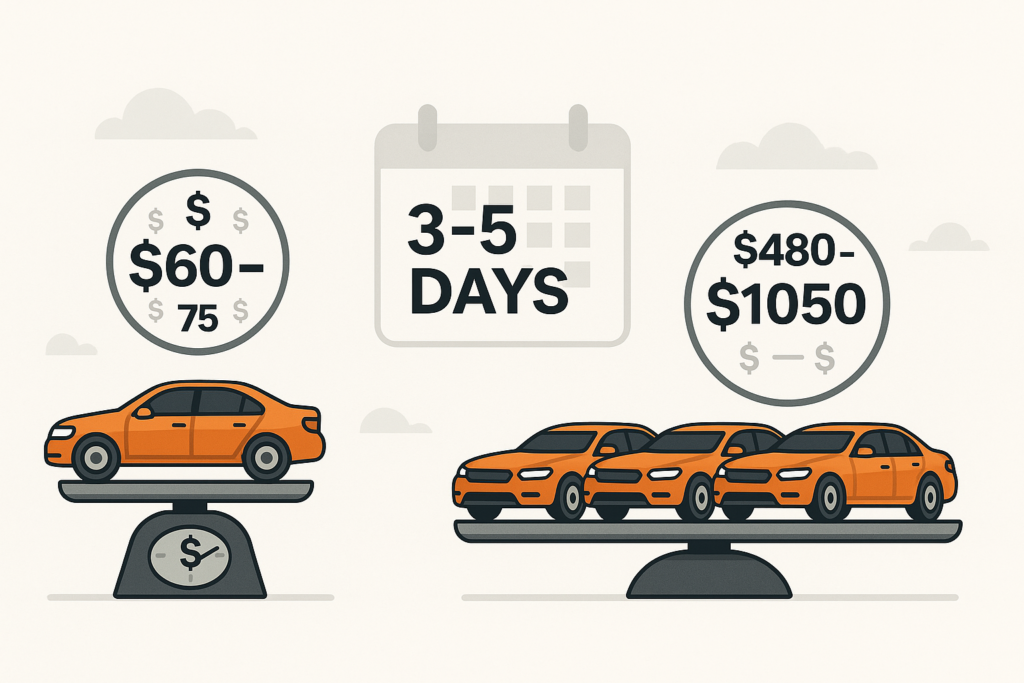

Every 24 hours a car idles in recon, it bleeds $60–$75 in holding costs before it even hits your lot. [Source: Simple Recon] Multiply that by the 8–14 days many stores still spend reconditioning a vehicle and you’re staring at $480–$1,050 of lost gross—per unit.

The good news? Top‑performing dealers are proving you can slice cycle time to three‑to‑five days with the right process and tech. [Source: Cox Automotive Inc.] This playbook shows you how to do it in 2025 using a modern reconditioning software stack.

Why Speed‑to‑Frontline Matters More Than Ever

- Tighter margins: Used retail inventory dipped 8 days YoY this spring, pushing prices up and room for error down. [Source: Cox Automotive Inc.]

- Customer expectations: Shoppers in 2025 find, finance, and reserve cars online in hours. If your fresh trade isn’t live fast, someone else’s is.

- Capital cost: Average floorplan interest now tops 9 %. At that rate, a 10‑day recon lag on a $25 k unit quietly adds $62 in interest alone.

Bottom line: Days‑to‑frontline (DTF) is the new heartbeat KPI for used‑car profitability. Beat the benchmark and you free up capital, win buy‑box pricing, and churn more turns per rooftop.

Benchmark Your Current Recon Cycle

| Metric | Average Store | Best-in-Class Goal |

| Acquisition-to-Inspection | 1.5 days | ≤ 0.5 day |

| Total Mechanical | 4-6 days | ≤ 2 days |

| Cosmetic / Detail | 2–3 days | ≤ 1 day |

| Photo & Merch | 1 day | Same‑day |

| Total DTF | 8–14 days | ≤ 5 days |

Five Levers Modern Vehicle Reconditioning Software Pulls

1. Real‑Time Workflow Visibility

Colour‑coded boards show every car’s status at a glance, so approvers sign‑off in minutes—not overnight. [Source: Carketa]

2. Automated Vendor Approvals & Parts ETAs

No more phone‑tag. Internal chat + mobile push alerts cut hours of dead air and catch parts delays before they snowball.

3. Mobile Photo & Video Condition Capture

Techs log damage on‑the‑spot; managers okay ROs with a thumb‑tap. You stop rewriting estimates and cut re‑do’s.

4. Integrated Transport & Sublet Coordination

Built‑in ACERTUS quoting means you ship units directly from auction to your recon bay—or consumer driveway—without re‑keying data.

5. Data‑Driven Task Timers & Scorecards

Track ‘mechanical hours per unit’ and ‘detail stall time.’ High‑variance alerts flag the bottlenecks killing your DTF.

The ROI Math: How Many Dollars Are You Leaving on the Table?

| Scenario | Days‑to‑Frontline | Holding Cost @ $60/day | Extra Gross When Reduced to 5 Days |

| Typical store | 12 days | $720 | +$420/unit |

| Moderate | 8 days | $480 | +$180/unit |

| Best‑in‑Class | 5 days | $300 | Baseline |

How the Carketa Reconditioning Playbook: How it can work in your Dealership

| Playbook move | What your team experiences inside Carketa | Call-out from real trainings |

| 1 • Needs‑Attention launchpad | The dashboard surfaces only what’s overdue or stagnating, so manager open the app, click Needs Attention, and know exactly which VINs require action before coffee. | “It’s the first tab I tell every client to click when they start the day.” |

| 2 • Template‑driven workflow | Pre‑built recon and inspection templates ship with sensible time targets (green = on track, yellow = warn, red = past due). Required vs. “As Needed” steps let you skip the mechanic on a quick‑flip wholesale unit but enforce it on retail cars. | “Green is on time, yellow is a warning, red is past due… change a step to required and the vehicle can’t advance until it’s done.” |

| 3 • My Work auto‑assignment | When a GM drags a car into Transportation, the transport coordinator—and only that user or team—gets a task in My Work. No one else’s screen clutters up, and everyone can work from the mobile app on the lot. | “Assign a step to a person or team and it lands in their My Work queue instantly.” |

| 4 • Vendor & RO loop | External vendors receive a one‑time SMS or email link; they mark the job complete and submit parts + labor for approval right inside your account. Managers approve, and the workflow moves without phone‑tag. | “Register a tire shop once and they get a text link to mark tasks finished—totally optional, but it saves calls.” |

| 5 • Fast intake tools | VINs flow in via mobile scanner or Chrome extension—no copy‑paste. The minute the VIN lands, Carketa auto‑assigns the correct template and starts the clock. | “Scan with your phone or click the green Carketa button next to any VIN on a website; it drops straight into recon.” |

| 6 • Continuous coaching | A dedicated onboarding specialist runs the first call, tailors templates, and schedules a check‑in the following week. In‑app chat, email, or phone support stay on tap—so the playbook keeps improving without consultants. | “We’ll meet again next week, same time, to fine‑tune anything you need.” |

Ready to Put This Into Action?

Dealers using Carketa’s auto dealer reconditioning software routinely cut cycle time by 3–5 days in the first 60 days—without adding headcount. Want to see how?

👉 Book a live demo of Carketa Recon and start turning cars faster, today.

FAQ

What is reconditioning software?

A cloud platform that tracks every step between acquisition and frontline—inspections, ROs, vendor work, detail, photos—so nothing slips through the cracks.

How much does reconditioning delay cost?

Industry estimates peg holding cost at $60–$75 per day per vehicle. [Source: brandonhale.substack.comSimple Recon]

Can small independent lots afford it?

Yes. Most used car reconditioning software runs on a per‑rooftop SaaS model that pays for itself after reducing DTF by just one day per month.

Does it replace my DMS or service scheduler?

No—recon software integrates with both, acting as a transparent bridge that keeps inventory, parts, and service data in sync.