Take your inventory turn to the next level

The inventory management platform driving faster turn & easier dealership management.

TRUSTED BY

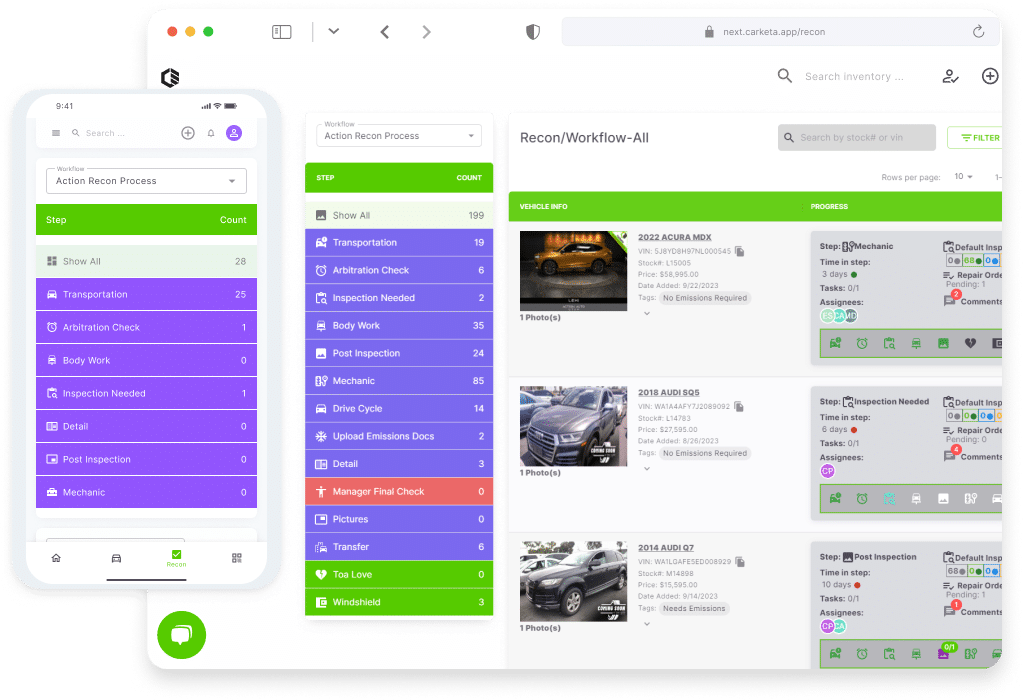

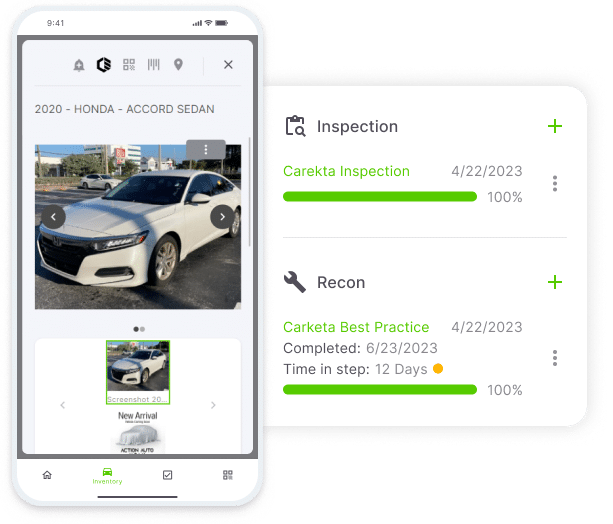

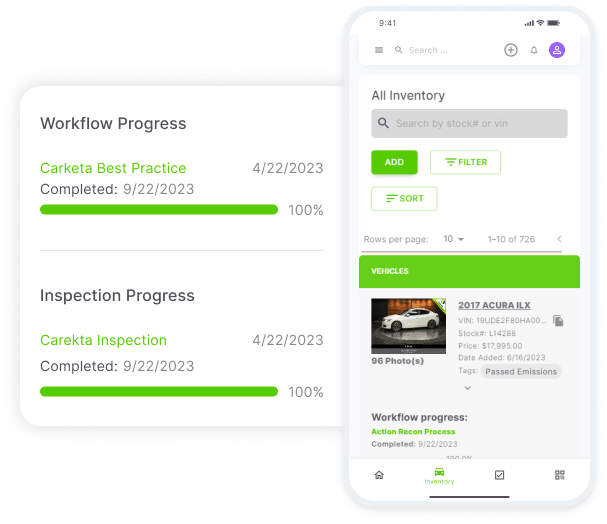

Manage your workflow to maximize your profit.

From acquisition to sale, we make every step easier for you and your team.

The inventory visibility you’ve been missing

Know where your inventory is every step of the way & manage your team’s workload at a glance.

Dealers rely on Carketa

Built for dealerships of all sizes.

Whether you’re a franchise, buy here/pay here or independent, Carketa is built with you in mind. Use our recommended workflows, customize a template or create your own to match the way you already work or upgrade your process.

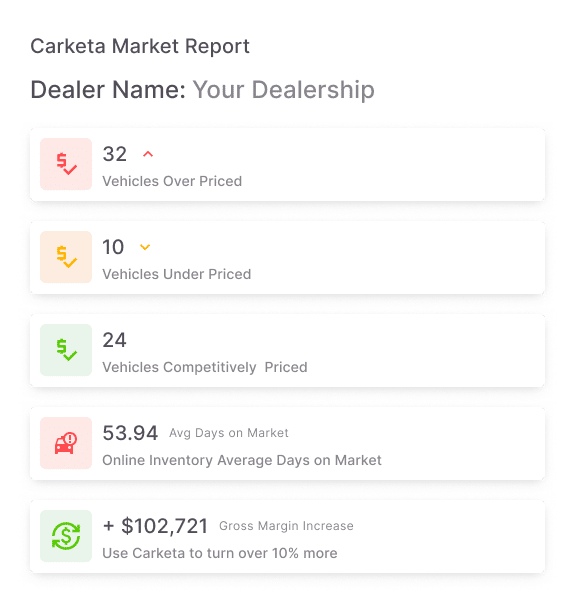

Get your frontline inventory analysis

Identify untapped opportunity in your current inventory. What vehicles are underpriced or overpriced in your current inventory, your average days to market and how much revenue you could be missing out on with better inventory turn.